In today's interconnected world, sending money across borders has become increasingly common. Whether supporting family abroad or conducting international business, the need for efficient and reliable money transfer services is paramount. Western Union stands as a prominent player in this arena, offering a widely accessible platform for online money transfers. However, navigating the landscape of Western Union's online money transfer fees can sometimes feel like traversing a complex maze. This article aims to shed light on these charges, empowering you to make informed decisions when sending money online.

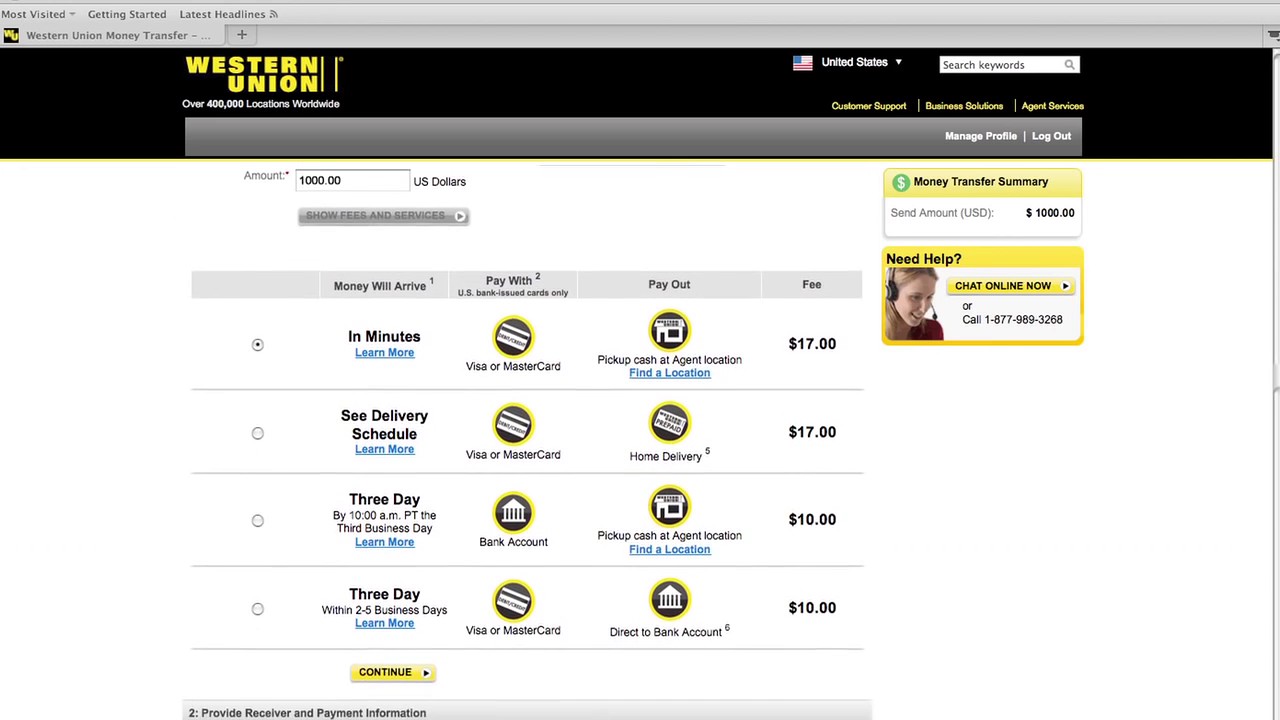

Understanding the pricing structure for online money transfers through Western Union is crucial. The cost of sending money via their online platform can fluctuate based on several factors, including the destination country, the amount being sent, and the chosen payment method. For instance, sending money to certain countries might incur higher fees than others due to currency exchange rates and local regulations. Similarly, larger transfer amounts could result in different fee structures compared to smaller remittances. Choosing to fund your transfer with a credit card might also influence the overall cost. Therefore, it's essential to carefully consider these variables to accurately estimate the total expense involved in your online money transfer.

Western Union's history dates back to the mid-19th century, initially focusing on telegraph services. Over time, the company evolved to include money transfer services, eventually becoming a global leader in the field. The emergence of online money transfers revolutionized the industry, offering a faster and more convenient alternative to traditional in-person transactions. Western Union embraced this digital shift, establishing a robust online platform. The importance of understanding Western Union's online money transfer fees lies in making cost-effective choices. By comparing fees with other money transfer providers and exploring different payment options, senders can potentially save money and maximize the value of their transfers.

A key aspect of managing Western Union online money transfer costs is comparing them with other services. Several online money transfer platforms offer competitive rates and varying fee structures. Taking the time to research and compare these options can significantly impact your overall expenses. Understanding how Western Union's fees stack up against its competitors is essential for making financially sound decisions when sending money online. This comparative analysis helps ensure you're getting the best possible value for your transfer while meeting your specific needs and preferences.

One of the main issues related to online money transfer fees, not just with Western Union, is transparency. While companies typically provide fee information, it's not always readily apparent or easy to understand. This lack of clarity can make it difficult for senders to accurately calculate the total cost of their transfer. Hidden fees or complex pricing structures can lead to unexpected expenses, highlighting the need for greater transparency in the industry. Consumers deserve clear and concise information about the costs associated with sending money online, empowering them to make informed choices and avoid unforeseen charges.

One benefit of using Western Union's online platform is the speed and convenience it offers. You can initiate transfers from the comfort of your home or office, 24/7.

Another advantage is the wide global reach of Western Union, allowing you to send money to numerous countries.

Finally, Western Union offers multiple payment and payout options, providing flexibility for both senders and recipients.

Advantages and Disadvantages of Western Union Online Money Transfers

| Advantages | Disadvantages |

|---|---|

| Speed and convenience | Potentially higher fees compared to some competitors |

| Wide global reach | Exchange rate markups can impact the final amount received |

| Multiple payment and payout options | Fee structure can be complex and not always transparent |

Frequently Asked Questions about Western Union Online Money Transfer Fees:

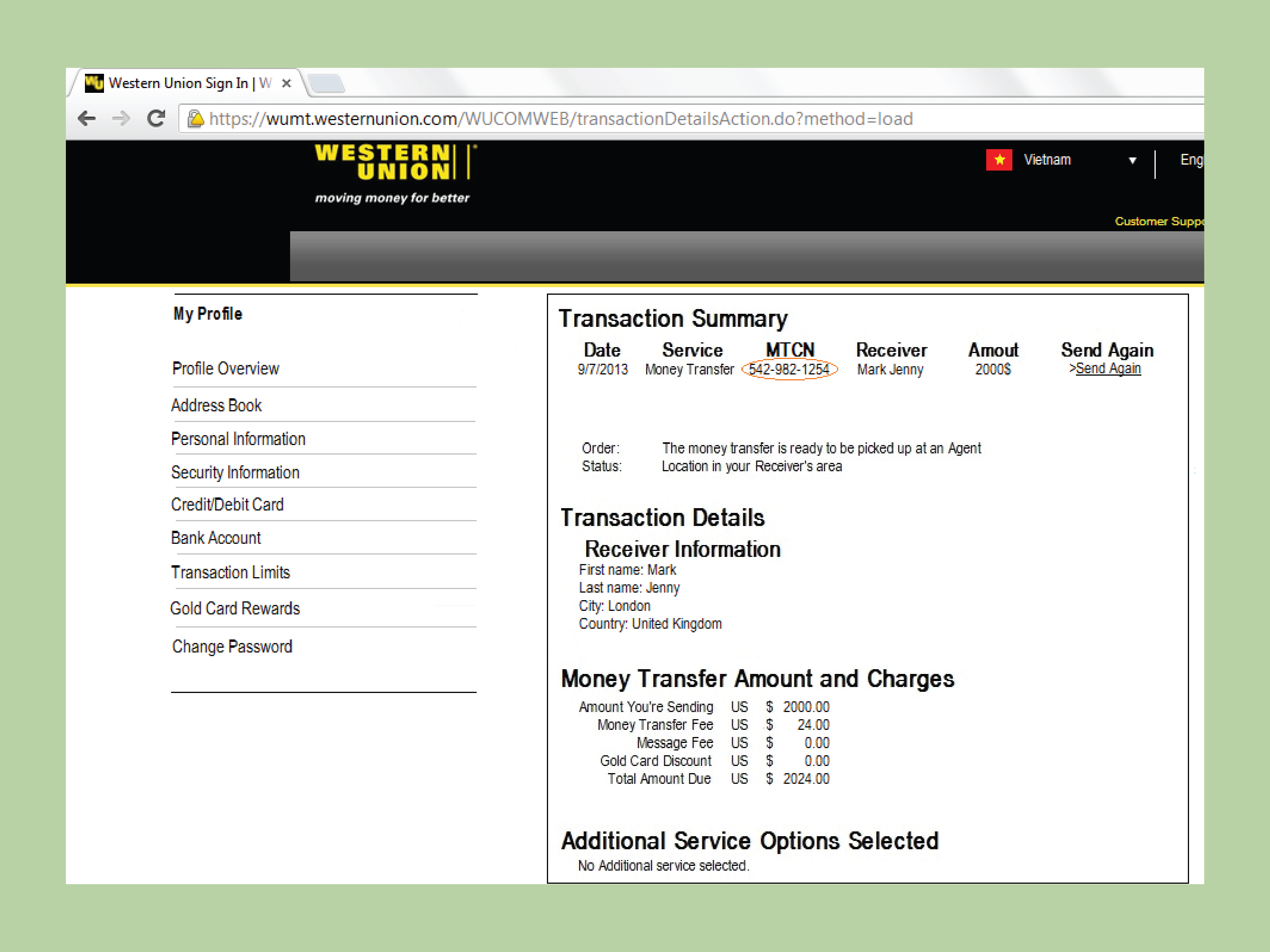

1. How do I find out the exact fee for my transfer? - Check the Western Union website or app.

2. Are there discounts for larger transfers? - Check Western Union's promotions page.

3. Can I pay with my credit card? - Yes, typically, but check the specific terms.

4. How long does the transfer take? - It depends on the destination and payment method.

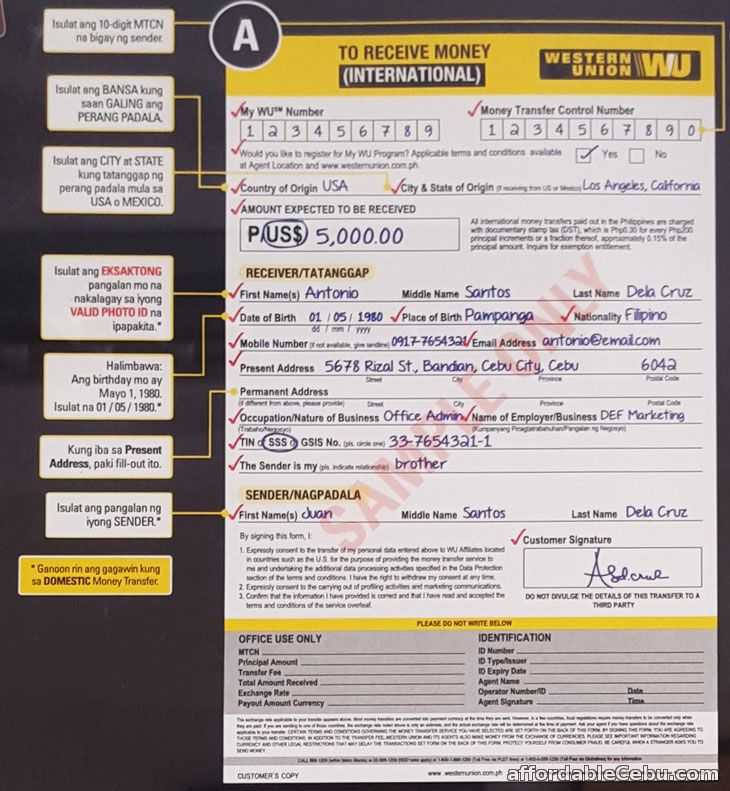

5. What are the recipient's fees? - Typically the recipient doesn't pay a fee for receiving money via Western Union.

6. How do I track my transfer? - Use the tracking number provided by Western Union.

7. What if my transfer doesn't go through? - Contact Western Union customer service.

8. Are there any limits on how much I can send? - Yes, there are limits which can vary.

Tips and Tricks: Compare fees with other services. Consider using a debit card instead of a credit card to potentially avoid extra charges. Plan your transfers in advance to avoid rush fees.

In conclusion, understanding Western Union online money transfer fees is crucial for making informed decisions about sending money internationally. By carefully considering factors like destination country, transfer amount, and payment method, you can effectively manage the costs associated with your transfers. Comparing Western Union's fees with those of its competitors, and exploring different payment options can lead to significant savings. While Western Union offers speed, convenience, and a vast global network, being aware of the potential for higher fees and exchange rate markups is essential. Ultimately, empowering yourself with knowledge about Western Union's online money transfer fees will allow you to make the most cost-effective choices and ensure your funds reach their intended recipients efficiently and securely. Take the time to research, compare, and plan your transfers to optimize your international money transfer experience.

Unlocking the field your ea sports fc 24 ea play guide

Nurturing villains a deep dive into i raised the villains preciously 47

Packaging solutions in clarksville tn your guide to effective product presentation